By Randall Margo, Ph.D

Board Director and Commentator; G.L.O.B.A.L. Justice

For decades, It’s a Wonderful Life has been shown every Christmas season. Besides being an icon of America’s cinematic history, this movie offers us a historic perspective of how credit, both financial and social, intertwined before today’s computers and technology. Set on Christmas Eve of 1945, the plot relives the life of banker George Bailey about to commit suicide because some of the bank’s money has been inadvertently misplaced by his absent-minded uncle, which unfortunately occurs just before a government audit of his bank’s financial records is due, placing the bank’s continuance in peril. I won’t spoil the ending for those who haven’t seen the movie, but suffice to say, the movie delves into topics of vital consequence in today’s world of credit.

Prior to the late 1800s the United States along with the rest of the world functioned primarily as cash societies, with goods or services paid in full upon delivery. Since there were few expensive items available for purchase, credit if used at all, was provided primarily to finance seed crops. Typically, this credit was provided by other family members, or local retailers, whose businesses relied upon the local farming community for their own livelihood. In essence, borrowers were well known to lenders, and consequently, so were their characters, trustworthiness, and reputations, which formed the basis for most credit transactions.

When the industrial revolution took hold, consumer goods such as sewing machines, bicycles, and kitchen stoves were made available. However, these items were too expensive for most families to purchase with cash, creating a dilemma for manufacturers – how to enable mass-produced products to be obtained by the masses at a profitable price. “The big breakthrough came in 1919 when General Motors Acceptance Corporation (GMAC) became the first to make financing available to middle-income car buyers.” Soon, other manufacturers followed with their own installment credit financing.

Manufacturers were still tied to their customers, much as the local retailers of the past had been connected with the local farmers, with the added benefit of having their product serve as collateral in case full repayment failed to occur. What had been lost, was the personal knowledge of borrowers’ creditworthiness and therefore, the trust and goodwill forged between borrower and lender. This is where the George Bailey’s of the world united homeowners and businessmen with the credit necessary to enrich their lives, and if necessary forego strict repayment during difficult financial times with the conviction that creditable people would ultimately make good on their debts. Social credit largely served to augment financial credit between local banker and local borrower. Meaning, your reputation, character, and references were key aspects in borrowing on credit from your local banker.

Several years after the movie’s premier in 1946, Diners Club pioneered the first credit card not tied to a specific vendor. Instead, Diners Club signed up hotels and restaurants and issued their cards to creditworthy people willing to pay a yearly fee for the convenience of not needing cash or a check to pay a bill. Diners Club paid the bills upfront minus a service fee to the business, and then sent a monthly invoice to the cardholder.

Initially, Diners Club cards were issued to the more affluent, with full payment due at each billing period, as the ability to profitably expand credit to the general public was limited by two critical risk factors: how much credit could be offered based on the ability to repay and who had the strength of character to repay what was owed. The application process could determine one’s income, thereby establishing a reasonable line of credit limit; however, the character question still constituted a large unknown, simply because the lender had no personal knowledge of the individual requesting credit.

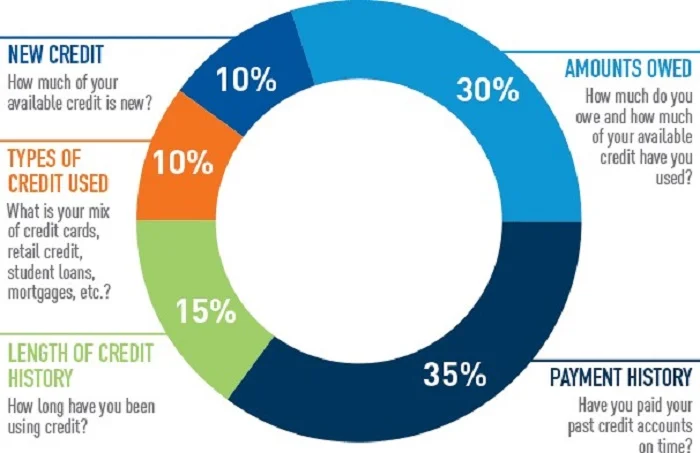

A revolutionary change began to emerge in the late 1950s when the prowess of electrical engineering merged with mathematics through Bill Fair and Earl Issac, who formed a data analytics company. With the use of primitive 1950s technology, their firm Fair Issac and Company would develop the first algorithm to assess credit risk, eventually evolving into what we know today as the FICO score, as summarized in the diagram below.

Source: Sallie Mae

Fast forward to today and we not only have the ability to pay most purchases with credit cards, but can utilize revolving credit, albeit with interest, to repay just a minimal portion of the debt we have accrued. More importantly, with our technological advancements, we can now make an increasingly amount of purchases with our smartphones, which brings us full circle to the unification of financial and social credit.

Where this knotty fusion of financial and social credit is becoming more prominent is China. While the use of payments by smartphones is in its infancy in the United States, its usage is ubiquitous in China, and currently dominated by two firms, Alibaba, which controls the application Alipay through its subsidiary Ant Financial, and Tencent, which controls the application WeChat. Alibaba is commonly referred to as the Amazon of China, with its broad reach into consumer goods, while Tencent’s WeChat likens comparisons to its U.S. counterpart, Facebook. A recent article in the Wall Street Journal reported that over 9 trillion payments occurred in China during 2016 among nearly 500 million users, quadrupling the quantity of payments made this way in 2015. Totaling $5.5 trillion in mobile payments, China dwarfs the roughly $112 billion made last year in the United States.

By now, probably a clear majority of Chinese adults utilize smartphones to make most of their purchases. Using their mobile phones for all these purchases with QR scanning codes built into each phone, including sending money back and forth to friends and relatives, this data is captured to create a credit score for each individual. The most successful of these credit scores is Alibaba’s Zhima (Sesame) Credit. However, Sesame Credit involves more than just your financial credit. It has evolved into a social integrity system, which monitors and merges your social behavior with your financial transactions. If you have an unpaid traffic ticket, cheated on an exam, or have friends with low credit scores, your Sesame Credit score drops. Consequently, people with high credit scores tend to shun friends, acquaintances and even businessmen with low credit scores, to ensure that their own credit score won’t be lowered. Why is a low score problematic? In China, as in the United States, a higher credit score assists one in obtaining credit at a low-interest rate, renting an apartment, or starting a business, but more ominous uses is to ban travel, as happened to one journalist interviewed by Wired Magazine.

Concern is rising that the Chinese Government will usurp the private credit systems placing restrictions on those in disfavor with government policies, as facial recognition integrates with mobile phone technology, thereby enabling identification and sanction of those observed attending anti-government demonstrations, religious sites, such as churches or mosques, or other situations the government dislikes. Currently, over 30 local governments are using different criteria to ascertain an individual’s social credit.

As technology accompanied by algorithm continues to proliferate through modern society, we’re creating a world where trust is completely divorced from its historical context of one person’s judgment about another, replaced by opaque and perhaps subjective criteria to a number that advances or confines one’s choices and opportunities in life. The benefits of this model allows one to conveniently conduct business with complete strangers – think Uber or Airbnb – with confidence, making commerce much easier. Of course, it eliminates the George Bailey’s of our world. Only time will tell if we will miss his personal approach to assessing the character of individuals.

https://www.wsj.com/articles/chinas-mobile-payment-boom-changes-how-people-shop-borrow-even-panhandle-1515000570

https://www.wired.com/story/age-of-social-credit/

https://theconversation.com/chinas-dystopian-social-credit-system-is-a-harbinger-of-the-global-age-of-the-algorithm-88348

The views and opinions expressed are those of the author(s) and do not imply endorsement by G.L.O.B.A.L. Justice. We are a faith-based, nonpartisan organization that seeks to extend the conversation about justice with a posture of dignity and respect.